Your Dreams Our Mission

Whether you're investing for freedom, family, or your future — it starts with a goal. Pick what matters most, and we’ll build a simple, personalized plan for your timeline.

About Us

Driven by Knowledge, Built on Trust

Welcome to Arya Finsecure Services, your trusted financial companion in India. We understand that your financial journey is more than just numbers it's a story of dreams, aspirations, and the legacy you want to leave behind. At Arya Finsecure Services, we are driven by the belief that everyone deserves a secure and prosperous future.

22+ Years of Experience

Proven track record of success and stability in the financial sector.

Wealth-Building Focus

Committed to helping clients achieve long-term financial growth.

Strong Leadership

Led by a visionary team with strategic expertise and integrity.

Diversified Investments

Smart asset allocation to manage risk and maximize returns.

Honors & Awards

Recognitions that reflect our commitment.

Our consistent dedication to client success has earned us industry awards and recognition. These honors reflect our commitment to ethical practices, innovative strategies, and real results for every investor.

Certificate of Appreciation

Certificate of Appreciation

Certificate of Appreciation

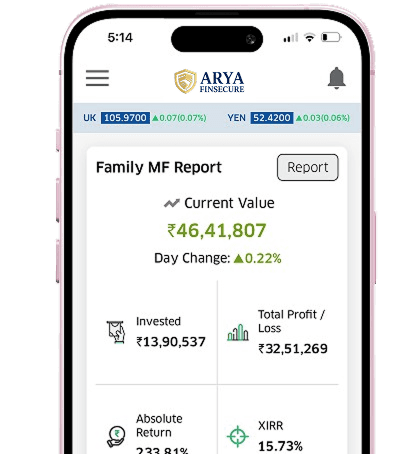

Financial Tools

Investing Made Simple

Investing made easy with smart and simple tools that break down complexity, give you real-time visibility into your portfolio, and let you invest with confidence.

Financial Calculators

Easily calculate SIP returns, retirement needs, loan EMIs, and more with our smart financial calculators.

Health Profile

Track and analyze your health metrics to make informed lifestyle choices.

Pay Premium Online

Quick and secure online premium payment facility for all your insurance policies in one place.

Useful Links

Explore curated financial links including government portals, regulatory bodies, and investment resources.

Risk Profile

Understand your investment risk appetite with our quick risk profiling questionnaire.

Fund Performance

Track and analyze the latest mutual fund performance to make informed investment decisions.

Financial Calculators

Easily calculate SIP returns, retirement needs, loan EMIs, and more with our smart financial calculators.

Health Profile

Track and analyze your health metrics to make informed lifestyle choices.

Pay Premium Online

Quick and secure online premium payment facility for all your insurance policies in one place.

Useful Links

Explore curated financial links including government portals, regulatory bodies, and investment resources.

Risk Profile

Understand your investment risk appetite with our quick risk profiling questionnaire.

Fund Performance

Track and analyze the latest mutual fund performance to make informed investment decisions.

Funds

Top Performing Funds

Explore the funds which gives you better return with our guidance & support. Fund List

No data available.

Services

Explore What We Offer?

Investing made easy with smart and simple tools that break down complexity, give you real-time visibility into your portfolio, and let you invest with confidence.

Different Funds

Choose a right investment platform

With the same monthly amount, your money can grow slowly — or significantly. Compare popular investment options side by side and see how much more you can earn by choosing wisely.

₹ 7,00,454

Saving Account

(with 3% return)

₹ 8,23,494

Fixed Deposit

(with 6% return)

₹ 9,74,828

Gold

(with 9% return)

₹ 13,93,286

Mutual Fund

(with 15% return)

Direct vs Regular

Know the Key Differences

Direct Plans

-

०

Investor manages everything on their own – from fund selection to portfolio review. -

०

Lower expense ratio (no distributor commission). -

०

Requires time, research, and confidence to manage on your own. -

०

One-size-fits-all — no tailored advice or adjustments. -

०

High chance of emotional decisions, panic exits, or inconsistency.

Regular Plans

-

०

Full support from a qualified MFD – from selection to rebalancing. -

०

Slightly higher expense ratio (includes MFD commission). -

०

MFDs handle documentation, tracking, and even KYC. -

०

Investment is tailored based on goals and market conditions. -

०

MFDs help maintain discipline during market volatility.

FAQs

What People Ask Before Starting

What is the importance of life insurance?

+Life insurance provides financial security to your loved ones in case of an unfortunate event. It ensures that your family can maintain their lifestyle and meet essential expenses even in your absence.

How do mutual funds work?

+Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. A professional fund manager manages these investments, aiming to generate returns while reducing risk through diversification.

What is a Systematic Investment Plan (SIP)?

+A SIP allows you to invest a fixed amount regularly in a mutual fund. It helps in disciplined investing, averaging out market volatility, and gradually building wealth over time.

How can I plan my finances effectively?

+Effective financial planning involves assessing your income, expenses, savings, and investments. Setting clear goals, budgeting, and investing wisely in insurance, mutual funds, and other instruments can help achieve financial stability and growth.

What are the risks involved in investing in mutual funds?

+Mutual funds are subject to market risks. Equity funds can be volatile, bond funds can be affected by interest rate changes, and all funds are influenced by economic conditions. Diversification and understanding your risk tolerance are essential before investing.

Our Team

People Behind Your Portfolio

We’re a team of SEBI-registered experts who help you plan, track, and tweak your investments.

.png&w=1920&q=75)

Ajay Arya

Founder

Blogs

Our Latest News & Articles

.jpg)

Call for Inquiry

7698009001Send us email

aryafinsecure@gmail.comStart the

Conversation

From personalized advice to smart tools, our team is ready to help you move forward with clarity and confidence.